So You Want to Buy a Building

You’ve had your business for a while and you’re paying rent to a landlord. Rent and occupancy costs are likely one of your highest costs next to payroll. Why not pay rent to yourself and purchase a building? There are lots of things to consider before making the leap to owning a commercial building.

Here are some considerations to think about.

Location, Location, Location…

If you’re a business that has customers or clients walking in of course you want to think about location. Premium locations come with premium prices. It’s important to weigh the reduction in costs against the potential reduction in revenue if you’re not on the main drag. Do the math and ask other businesses in the area you are considering buying in about customer traffic. Can a less than perfect location be offset by having an online store? Consider parking and foot traffic.

If you’re specialized enough and people seek you out or you don’t have customers coming to you, maybe the location doesn’t matter as much. In this case, you want to consider ease of access for your employees. Is there public transportation for staff to get to work or is it a location that requires them to drive? Are there services around to support your staff like restaurants, banks, and medical clinics? Is there enough space to add amenities for staff like a cafeteria, outside space for break time, and free parking?

Working with a Realtor

Your realtor will be your guide to the entire process. Choose a realtor that is familiar with commercial real estate. Your realtor will be able to pull details on listings of buildings in the area you are interested in to see what they have sold for. They will also be able to see what rents are like in the area. This is important as it is the same information the Valutor will gather when determining the value of the building for the bank.

Choose a realtor you can trust and that will take the time to explain the process and support you as you navigate it. Your realtor should be able to point out the pros and cons of the building and give you an opinion on how much they actually think it will sell for.

Consider the Building itself

Just like buying a home you want to understand what you’re getting into with a building. Ask if the vendor has any of the following reports:

- Environmental site assessment (ESA)

- Structural report or Building Condition report

- Hazardous Building materials (previously DSS) report

Similar to a home you want to think about the roof and windows but what about all of those nasty things lurking in the walls?

First, consider the structure of the building. If the vendor doesn’t have a building condition report (and maybe even if they do) you will want to engage a property surveyor to complete a Building condition report. This report is very similar to a home inspection but for a commercial building but more detailed. An inspector will come out and visually inspect the property as well as reviewing repair and maintenance histories and interview facilities and maintenance staff.

If you’re buying a building built prior to 1979 you’ll want to have a Hazardous Building materials assessment (previously called a Designated Substance Survey) done by a certified professional, especially if the building has any popcorn ceilings. The surveyor will come in and take samples from different substances in the building including various walls, floors and ceilings and send them to a lab for testing to determine if they contain any designated substances such as asbestos, lead, benzene etc. If you intend on doing any renovations to the building you will need this report in place prior to construction so that the substances can either be removed and disposed of properly by a certified practitioner or so your contractor can be informed and take precautions when working around the affected areas.

In addition to dangerous substances in the building you also want to think about the building site itself. Is the site contaminated and would you need to do remediation on the site prior to using it for your business? Ask for an Environmental Site Assessment *ESA” report from the vendor. There are two types of ESA reports Phase 1 and Phase 2. The difference between the assessment is how much work is done to determine the potential contamination. Phase 1 reports gather information from readily available documentation about the building from past owners and regulatory agencies as well as an inspection by an environmental professional. Phase 2 also includes sampling of soil, water, storage tanks, etc.

If the site is contaminated there can be significant costs associated with remediation so you want to do your due diligence on this one.

How much Can I Afford?

Just because you could afford $10,000 in rent a month doesn’t mean you should buy a building that has a monthly mortgage payment of $10,000. There are many additional costs to consider when buying a building. In addition to your mortgage cost, you’ll also have property taxes, utilities, and maintenance including snow removal and landscaping. If your current lease is a triple net lease you may already know how much you’re explicitly paying for these things. You’ll want to set aside funds for heating and cooling maintenance and roof repairs. These costs are significant and are hard to predict. If you’re buying a building that’s bigger than you need for your own business and you intend to rent some of it you want to consider whether or not you could cover the carrying costs of the building without your tenant. If COVID has taught us anything it’s to be prepared for the unexpected.

Financing

If you’re financing the building you’ll want to have an initial conversation with your preferred lender prior to putting in an offer to determine what funds may be available. You’ll also want to put the offer is conditional on receiving financing. This is similar to buying a home but the dollars are usually significantly larger so you definitely want to reread the offer to make sure the financing condition is there.

Banks generally love to lend money against property or buildings but they also want to know that you have a tenant lined up. If you’re moving into the building yourself and your business will fund the mortgage that reduces the bank’s risk. If you have other tenants moving in the bank will want to know you’ve got letters of intent from your future tenants.

The bank will require a minimum of two years of financial statements for your business including income statement and balance sheet. Make sure your current occupancy costs are obvious so the bank can easily pull them out. They may also ask you to sign a personal guarantee. How much the bank will lend depends on the current economic climate. Some banks will lend up to 100% of the cost of purchase for a building. Make sure that you take note of the covenants required by the bank and be prepared to provide financial statements on a regular basis going forward.

Thoughts for the future

In addition to making your rent payments work for you, there are some other benefits to owning commercial real estate including the ability to borrow against it at a future date, the potential for appreciation of the value of the property, and the opportunity to rent to other tenants to provide additional cash flow.

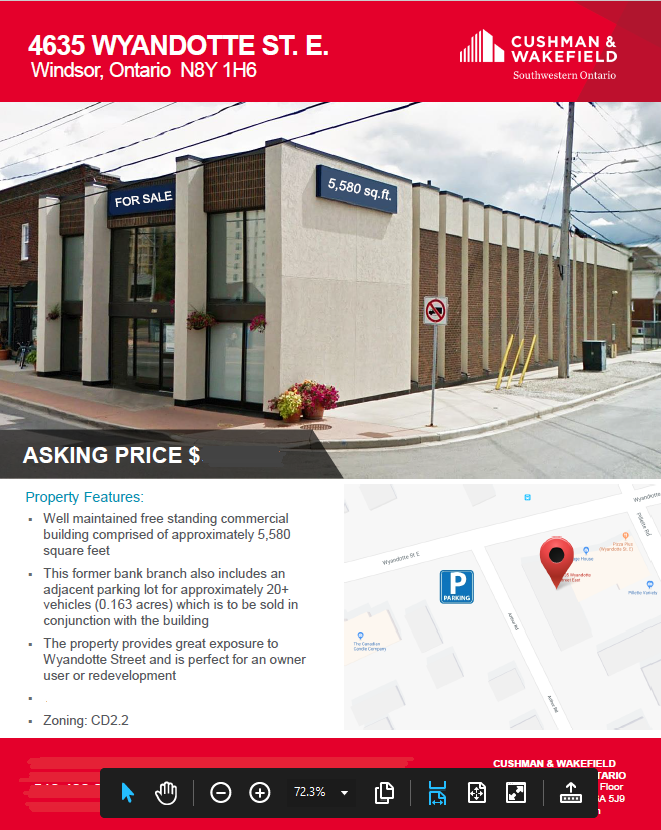

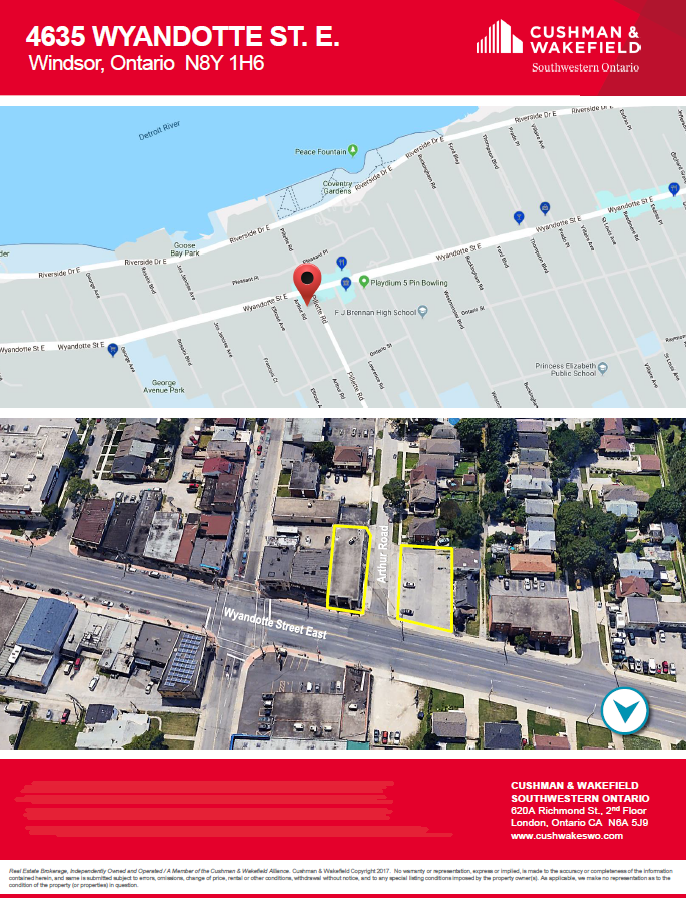

At Hawkins & Co. we are excited to share our experience of purchasing and transforming an old Royal Bank branch into our new office, complete with the vault. Stay tuned to read more about our journey as we moved into our new “home”.

COVID INSIGHTS:

The irony of this blog series is that we purchased a building a few months before COVID lockdown and the purchase closed during the first lockdown. Our plan was to close the deal on April 30th at the end of tax season and start construction right after but of course with COVID life had other plans -tax season was extended to September 30th, construction was busy with everyone working from home and deciding to do renovations and materials were harder to come by.

On a different note, our hybrid firm of virtual and in-office team members proved we really can work completely virtually with no impact on client services. As of today, we have yet to have our entire team in the new space together. Even with all that said it was still right for us. The reality of working at home is that it works for some and not for others. A positive working from home experience is dependent on many things including the space you have available in your home to work, the number of other people in the home, and an individual’s need to be with other people. Often these things are impacted by your stage of life but in some cases, they are also a personal preference. I don’t believe our entire Windsor-based team will ever be in the office together every single day when life heads towards normal again but many will most of the time. We will have the flexibility to do both. Our new building allows us the flexibility to meet with Windsor-based clients in person and put down a home base in one of the communities we serve. We look forward to the time where we can meet with those clients that want to in person, shake their hand, or give them a hug.

Some considerations about working from home as we move towards a post-COVID world: https://www.steelcase.com/research/articles/topics/work-better/hidden-bias-working-home/

~ Allison